Paycheck calculator multiple states

The calculations include federal state and local withholding. Free salary hourly and more paycheck calculators.

New York Paycheck Calculator Adp

All Services Backed by Tax Guarantee.

. Ad Learn How To Make Payroll Checks With ADP Payroll. This free easy to use payroll calculator will calculate your take home pay. To get more accurate results that.

Ad Learn How To Make Payroll Checks With ADP Payroll. Heres a step-by-step guide to walk. All inclusive payroll processing services for small businesses.

Federal Salary Paycheck Calculator. In the tax world nexus refers to a businesss connection between a taxing jurisdiction such as a state county township etc. Get 3 Months Free Payroll.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W-4. Use ADPs Minnesota Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Ad Compare Prices Find the Best Rates for Payroll Services. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. State Pay Cycle. Get a free quote today.

Calculating your Illinois state income tax is similar to the steps we listed on our Federal paycheck calculator. Get 3 Months Free Payroll. The state tax year is also 12 months but it differs from state to state.

Just enter the wages tax withholdings and other information required. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information. Make Your Payroll Effortless and Focus on What really Matters.

Ad Payroll So Easy You Can Set It Up Run It Yourself. So the tax year 2022 will start from July 01 2021 to June 30 2022. Use Withholding Calculator to help get right amount for 2019.

Fast Easy Affordable Small Business Payroll By ADP. Enter your annual salary or earnings per pay. Supports hourly salary income and multiple pay frequencies.

If a business is said to have nexus it means the business has a. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Important Note on Calculator.

Use PaycheckCitys dual scenario hourly paycheck calculator to compare two hourly paycheck scenarios and see the difference in taxes and net pay. IR-2019- 107 IRS continues campaign to encourage taxpayers to do a Paycheck Checkup. Go To Gross-Up Calculator.

Get a free quote today. This calculator will help to determine your paycheck amount after taxes and benefit deductions have been subtracted. Paycheck Manager offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Preparation and Processing needs.

Fast Easy Affordable Small Business Payroll By ADP. Ad Accurate Payroll With Personalized Customer Service. This module calculates Paycheck withholding either from GROSS pay to NET pay or NET pay to GROSS pay.

This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax. This federal hourly paycheck. Part-year residents not only pay tax on income earned from work performed in the state but also pay tax on all other income received while residing in the state.

Some states follow the federal tax. Get 3 Months Free Payroll. Get 3 Months Free Payroll.

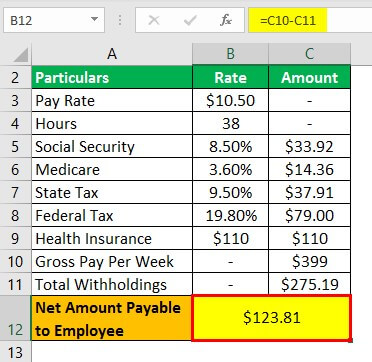

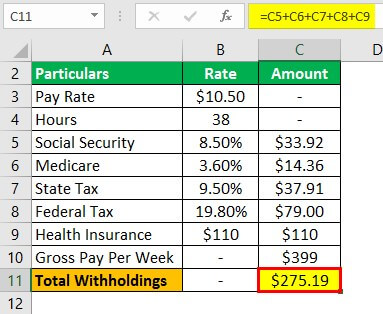

Payroll Formula Step By Step Calculation With Examples

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp Payroll Payroll Software Savings Calculator

Hourly To Salary What Is My Annual Income

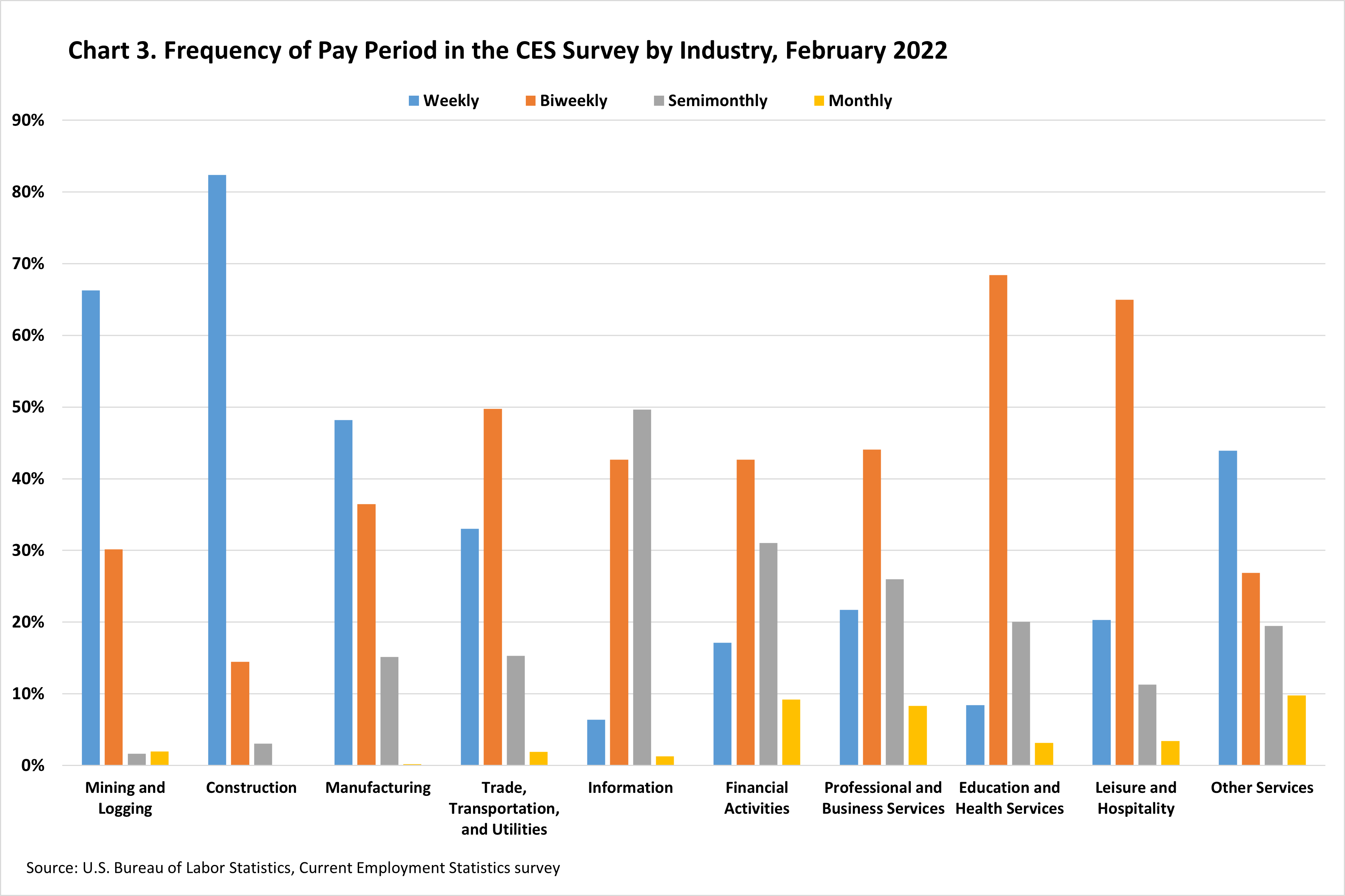

Length Of Pay Periods In The Current Employment Statistics Survey U S Bureau Of Labor Statistics

Paycheck Taxes Federal State Local Withholding H R Block

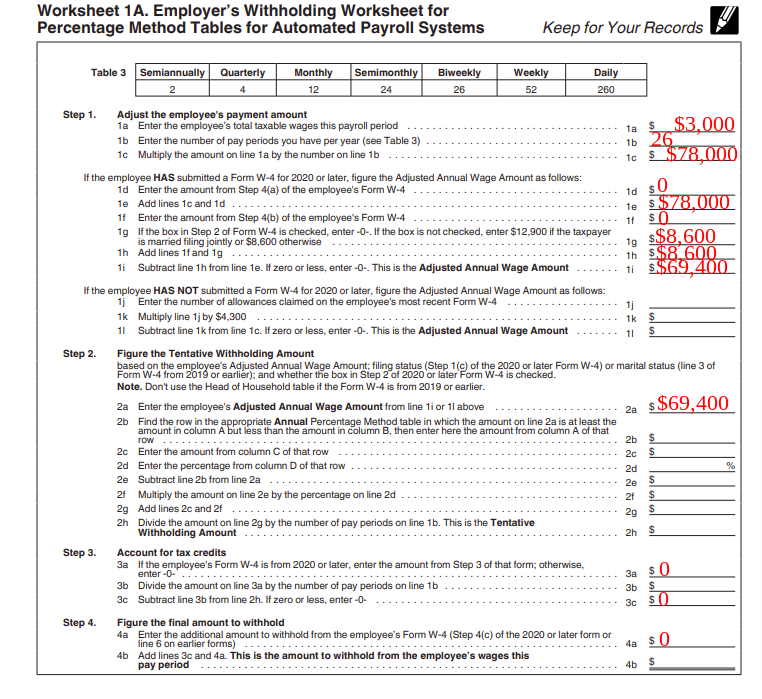

How To Calculate Payroll Taxes Methods Examples More

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Payroll Taxes Methods Examples More

Payroll Formula Step By Step Calculation With Examples

Understanding Your Paycheck Credit Com

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Th9gxwmhfoigrm

Overtime Calculator

How To Calculate Payroll Taxes Methods Examples More

Hourly To Salary Calculator Convert Your Wages Indeed Com

How To Calculate Overtime Pay For Hourly And Salaried Employees Article

Indiana Paycheck Calculator Smartasset